Content

Build a Powerful Compliance Risk Assessment Template

Build a Powerful Compliance Risk Assessment Template

November 8, 2025

Think of a compliance risk assessment template as your game plan. It’s a structured document you use to methodically find, analyze, and handle the risks tied to all those legal and regulatory rules your business has to follow. It’s really the bedrock of any solid compliance program.

Why You Need More Than Just a Generic Checklist

Let's be real—compliance can feel like a mountain of paperwork and red tape. But trying to wing it is a recipe for disaster. We're talking about everything from eye-watering GDPR fines to the kind of reputational damage that takes years to repair. A well-built compliance risk assessment template isn't just about checking off boxes; it's a strategic shield that helps you get ahead of threats, use your resources smartly, and protect your company's bottom line.

Forget the one-size-fits-all templates you find online. What truly makes a template work in the real world is its clarity and a direct line from risk to action. It takes dense, abstract legal jargon and turns it into a framework your team can actually use.

Taming the Regulatory Beast

The web of regulations just keeps getting stickier and more complex every year. That's not just a hunch; the numbers back it up. A recent report from Spacelift found that 85% of compliance pros feel regulations are getting harder to navigate, and a staggering 90% say their job responsibilities have expanded as a result. This isn't just an internal headache, either—82% of businesses report that this growing complexity is putting the brakes on their growth and transformation projects.

A solid template is your best tool for cutting through this noise. It gives you a repeatable process to:

Pinpoint every rule that applies to you, from niche industry standards to major data privacy laws like the CCPA.

Rank your risks by how likely they are to happen and how much damage they could cause. This lets you focus your energy where it counts.

Create a consistent standard so that every team, from marketing to product, is evaluating risk the same way.

Shifting from Firefighting to Fire Prevention

Without a template, compliance often turns into a reactive scramble. A problem pops up, and everyone drops what they're doing to put out the fire. Using a template flips that script entirely, letting you get out in front of issues before they blow up. For a fantastic deep-dive on creating this kind of framework, especially in a heavily regulated space, check out this proven bank risk assessment template.

A good template does more than just list what could go wrong. It weaves a culture of risk awareness into the fabric of your company. It becomes the single source of truth that gets legal, IT, and operations on the same page, making sure everyone knows their part in keeping the organization safe.

This proactive mindset is crucial. When you document potential threats and map out your response ahead of time, you're building a defensible position. You can walk into any audit and show regulators you have a thoughtful, organized process for managing compliance. That's how you turn a potential weakness into a real business advantage.

What Goes Into a Truly Effective Template?

What’s the real difference between a compliance risk assessment template that actually works and a glorified spreadsheet that just collects digital dust? It all comes down to the structure. A powerful template isn't just a list of things that could go wrong; it's a living tool that connects abstract regulations to your day-to-day business operations, giving you a clear roadmap from identifying a risk to getting it resolved.

Think of it as the architectural plan for your entire compliance program. If the foundation is weak, the whole structure is unstable. A well-designed template moves beyond vague categories and gives everyone in the organization a specific, standardized framework to follow.

Nail Down Your Regulatory Obligations

The bedrock of any solid risk assessment is knowing exactly which rules you have to play by. This is where your template needs a section to list every single legal, statutory, and contractual obligation your company is bound to. I’m not talking about a high-level summary here—you need to get granular.

For example, instead of a generic entry like "Data Privacy," you should break it down into specifics:

GDPR Article 30: The requirement to maintain detailed records of all data processing activities.

CCPA Section 1798.100: The consumer's right to know what specific pieces of their personal information are being collected.

SOX Section 302: The mandate for principal officers to personally certify the accuracy of financial reports.

Getting this specific is non-negotiable. It makes your entire risk assessment defensible in an audit because you can draw a straight line from a risk back to a concrete legal requirement. This level of detail is a cornerstone of good governance, and you can learn more by exploring some proven documentation best practices.

Define Your Risk Categories and Descriptions

Once you have your obligations listed, the next step is to translate them into specific business risks. "Risk categories" are your friend here—they let you group similar threats, like "Data Security," "Financial Reporting," or "Third-Party Vendor Management." But the real work is in the risk description that follows.

A lazy description like "Vendor issues" is useless. A strong, actionable description is "Failure to conduct adequate security due diligence on a new software vendor, potentially exposing sensitive customer data." See the difference? That level of clarity makes the risk tangible and far easier for everyone to understand and assess.

A great template forces clarity. It makes you move from abstract worries like "cybersecurity" to concrete, assessable scenarios like "unauthorized access to the customer database due to weak password policies."

Build Out Your Impact and Likelihood Scales

This is the part that turns your assessment from a qualitative exercise into a quantitative one. To do this right, you have to define clear, consistent scales for scoring each risk you've identified. Vague terms like "high" or "low" just won't cut it and lead to endless debate.

A simple but highly effective approach is to use a 1-5 scale for both impact and likelihood.

To bring this to life, here's a breakdown of the key columns your template should absolutely include. These elements work together to transform a simple list into a powerful analytical tool.

Essential Elements of a Compliance Risk Assessment Template

Component | Purpose | Example Data Point |

|---|---|---|

Risk ID | Provides a unique identifier for tracking and reference. | FIN-001 |

Risk Category | Groups similar risks for high-level analysis and reporting. | Financial Reporting Integrity |

Regulatory Obligation | Links the risk directly to a specific law, rule, or contract. | SOX Section 302 |

Risk Description | Clearly and concisely explains the specific risk scenario. | Inaccurate financial data reported due to manual spreadsheet errors. |

Existing Controls | Documents the current measures in place to mitigate the risk. | Quarterly internal audits; dual-approval for journal entries. |

Likelihood Score (1-5) | Quantifies the probability of the risk occurring. | 3 (Possible) |

Impact Score (1-5) | Quantifies the severity of the consequences if the risk occurs. | 5 (Critical) |

Inherent Risk Score | Calculates the risk level before controls (Likelihood x Impact). | 15 |

Residual Risk Score | Calculates the risk level after controls are considered. | 8 |

Action Plan | Outlines the specific steps needed to further mitigate the risk. | Implement automated reporting software by Q3. |

Owner | Assigns a specific person responsible for the action plan. | Jane Doe, Controller |

Due Date | Sets a clear deadline for the action plan's completion. | September 30, 2024 |

Having these components in place ensures you're not just identifying problems but also assigning ownership and creating a clear path to resolution.

By multiplying the likelihood and impact scores, you get a risk rating (e.g., a Likelihood of 5 x an Impact of 5 = a Risk Score of 25). This simple calculation is the engine of your template, allowing you to instantly sort and prioritize which issues need your attention right now. It turns a long list of worries into an objective, data-driven action plan.

How to Build Your Template from the Ground Up

Okay, let's move from the abstract idea of a template to actually building one. This is where the rubber meets the road, and a well-designed compliance risk assessment template shows its true value. Building one from scratch might sound like a huge undertaking, but it’s really about structured thinking and clear communication, not complicated formulas.

Think about a typical mid-sized tech company that handles sensitive customer data. Their first move isn't to jump into a spreadsheet. It's to get the right people in a room. This can't be a siloed task for the legal team; you need a mix of experts from IT, operations, legal, and even product development to see the full picture.

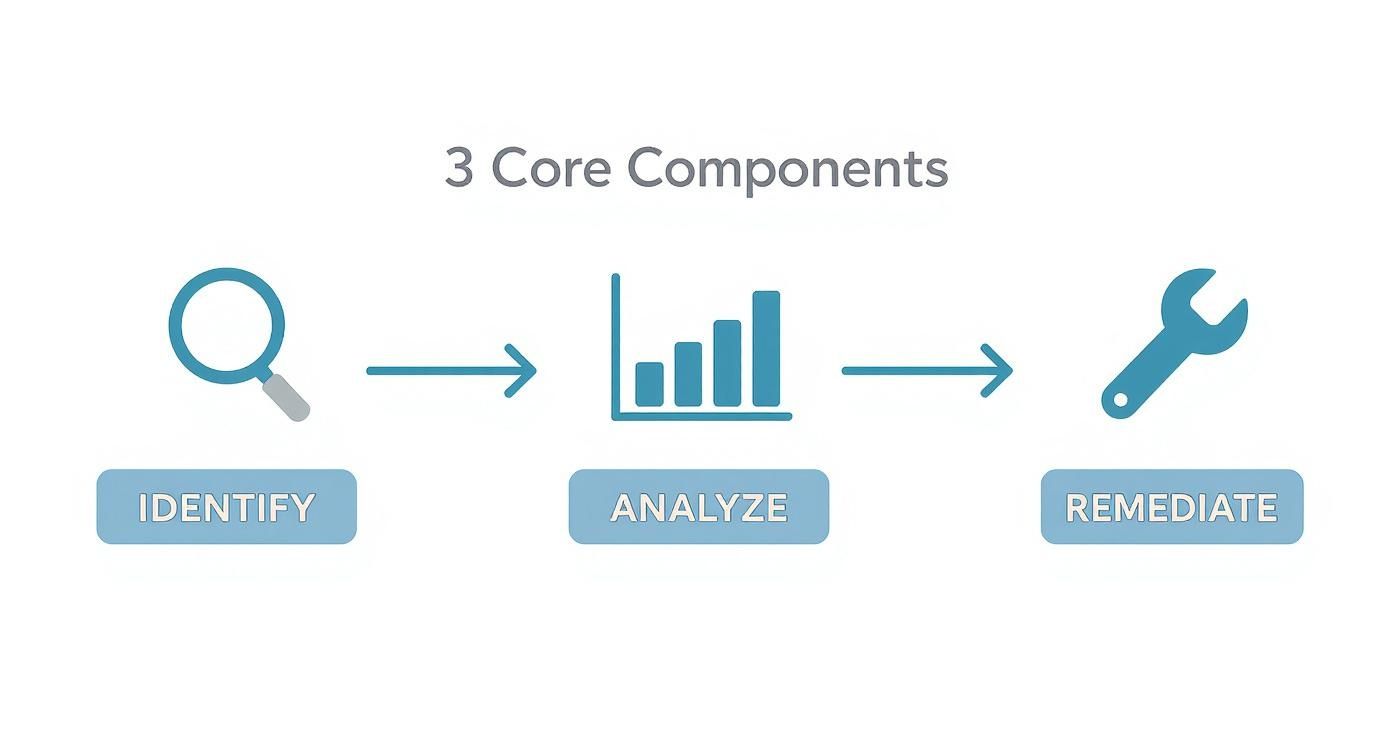

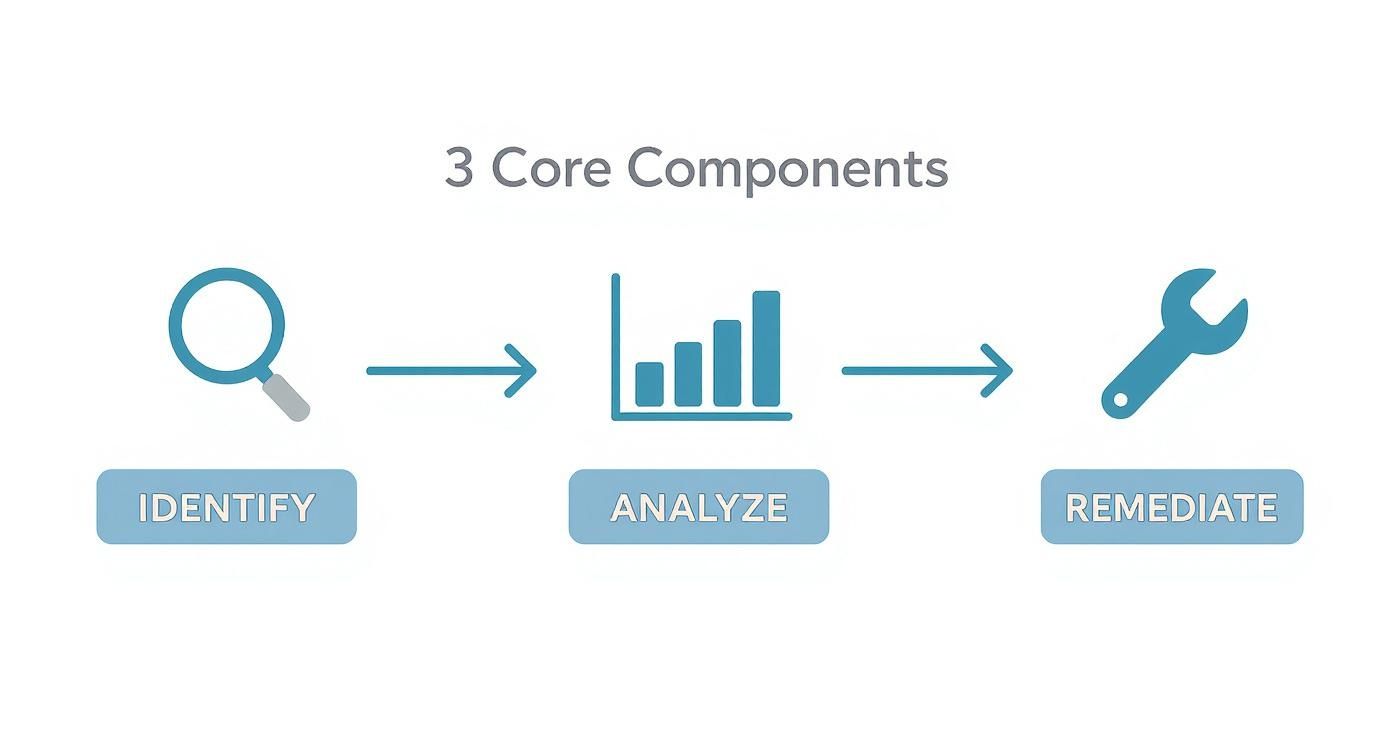

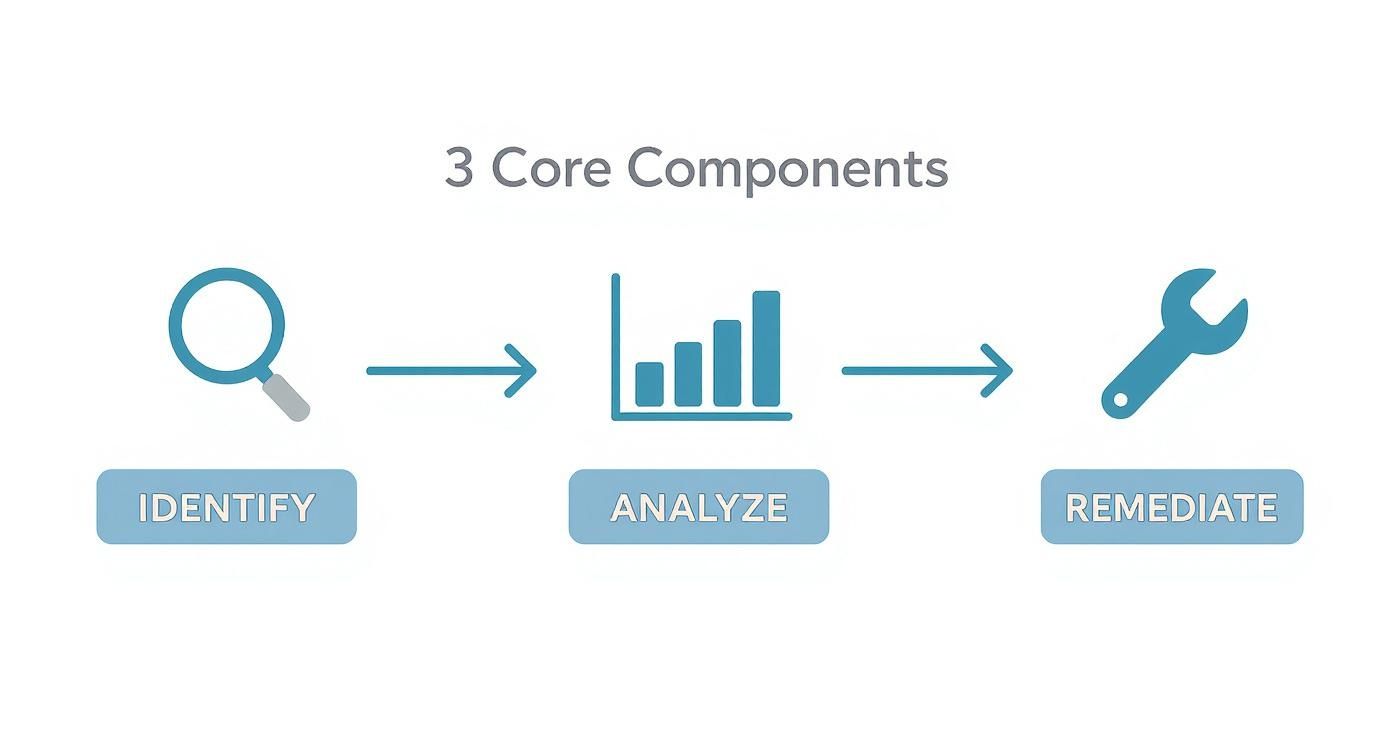

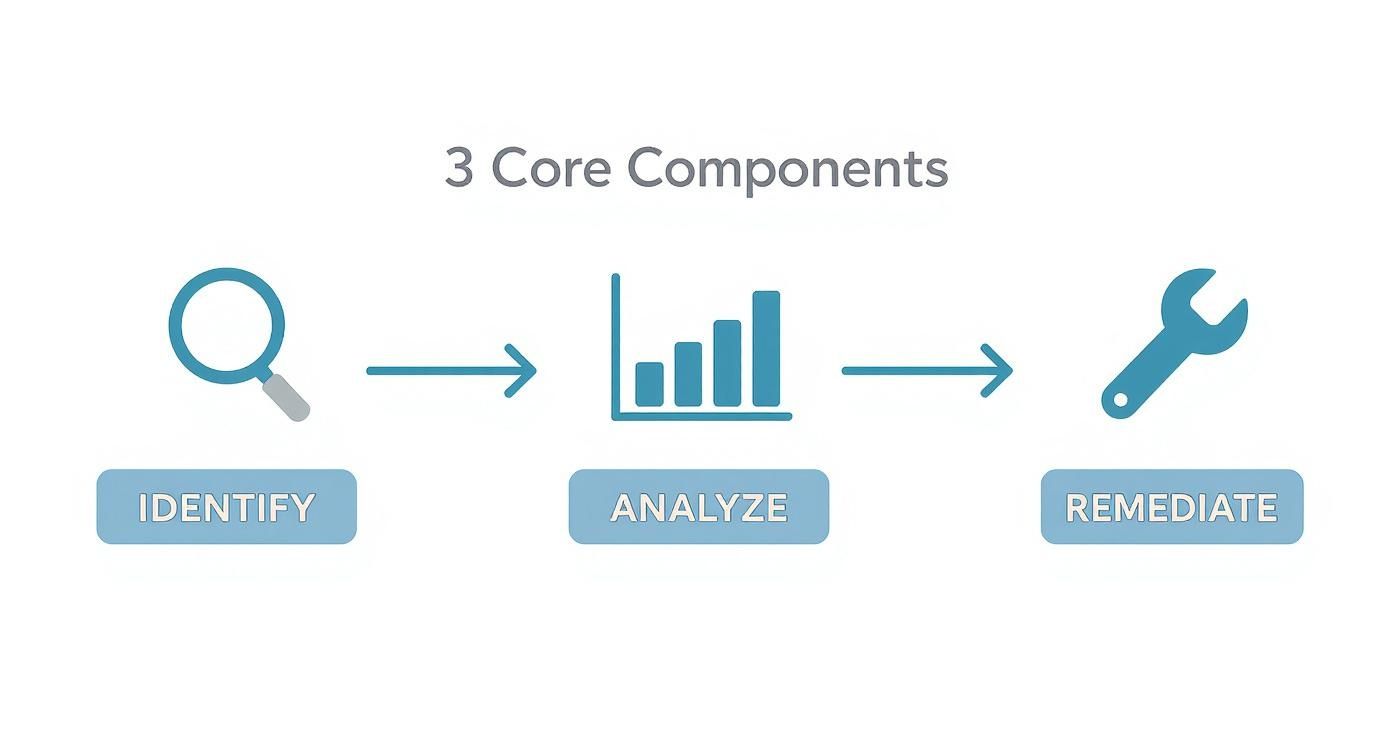

This workflow visualization breaks down how you can bring your own template to life, from the initial discovery phase all the way to resolving the issues you find.

This simple flow—Identify, Analyze, Remediate—is the foundation of any solid compliance program. It turns what could be a chaotic process into something you can repeat, scale, and rely on.

Identifying Your Specific Risks

Once you have your team assembled, the first order of business is a good old-fashioned brainstorm. The goal is to get every potential compliance risk out on the table. A great way to start is by looking at the big-picture regulations that apply to you, like GDPR or CCPA, and then digging into the specific ways they impact your daily operations.

For our imaginary tech company, a workshop might surface risks like these:

Data Breach Risk: Someone gains unauthorized access to the cloud databases where we store customer Personally Identifiable Information (PII).

Vendor Management Risk: A third-party marketing tool we use doesn't meet the data security standards laid out in our contract.

Access Control Risk: We discover that former employees still have active credentials for sensitive internal systems after they've left the company.

Notice how specific these are? They’re tied to actual business processes. Vague entries like "cybersecurity risk" are useless because you can't score them or figure out how to fix them.

Scoring Risks and Documenting Controls

After you've got a solid list of potential risks, it's time to analyze them. This is where you assign scores for likelihood (what are the odds of this happening?) and impact (how bad would it be if it did?). A simple 1-to-5 scale for both works wonders.

Let’s use the "Unauthorized access to customer PII" risk as an example. The team might decide its likelihood is a 4 (Likely) and its impact is a 5 (Critical). Multiply those, and you get an inherent risk score of 20, immediately flagging it as a top priority.

Next, you need to document the controls you already have in place to manage this risk. This could be anything from multi-factor authentication (MFA) and data encryption to your quarterly access reviews. Documenting these is vital because they help you figure out the residual risk—the risk that's left over after your safeguards are doing their job.

The point of a risk assessment isn't to get to zero risk—that’s a fantasy. It's about understanding your risks so deeply that you can manage them down to an acceptable level and show regulators you have a thoughtful, defensible process.

Creating Actionable Remediation Plans

This last part is arguably the most important: turning your findings into action. For every high-priority risk, your template needs a section for a clear remediation plan. I'm not talking about a vague suggestion; I mean a concrete to-do list with names and dates attached.

This isn't just best practice; it's what leading organizations do. In fact, 61% of professionals use their risk assessment results as the primary driver for improving their compliance programs, according to Navex Global's 2025 report. For more on how companies are tackling these issues, you can explore detailed compliance statistics.

A powerful remediation plan always includes:

A Specific Action: "Implement role-based access control (RBAC) for the production database."

An Assigned Owner: "John Smith, Head of Engineering."

A Firm Deadline: "End of Q3."

This simple addition transforms your template from a static document into a living, breathing project management tool. It ensures the problems you find don't just get filed away in a report—they actually get fixed. For more help formalizing processes like these, take a look at our guide on how to create standard operating procedures. By assigning ownership and timelines, you build a culture where everyone is accountable for continuous improvement.

Using Technology to Supercharge Your Template

Let's be honest: a static spreadsheet can only take you so far. To really stay on top of today's tangled regulatory web, you need to transform your compliance risk assessment template from a simple document into a living, breathing system. This is where technology—specifically Governance, Risk, and Compliance (GRC) software—comes in, turning a periodic chore into a continuous, value-adding process.

Instead of a template that gets a dusty, once-a-quarter update, picture a system that gives you real-time visibility. The right tools can automate control testing, pull all your compliance documentation into one place, and spit out executive-ready dashboards with a single click.

Moving from Static to Dynamic

The most significant upgrade you can make is shifting from a point-in-time snapshot to a continuous monitoring model. A spreadsheet is already outdated the moment you hit "save," but a tech-driven system offers a live look at your compliance posture.

This isn't just a nice-to-have; it's becoming essential. Regulations are only getting more complicated. According to PwC's Global Compliance Survey 2025, a staggering 77% of executives said compliance complexity had negatively impacted them, and 51% put technology risks at the top of their priority list. It's no wonder that organizations are turning to digital tools for dynamic risk scoring and real-time monitoring. You can check out some of the top compliance risk assessment tools on centraleyes.com to see what’s out there.

A good GRC platform will typically offer:

Automated Alerts: Get pinged the moment a control fails or a risk score crosses a critical threshold.

Centralized Evidence: No more hunting through shared drives. All audit evidence, policies, and procedures live in one accessible spot.

Streamlined Reporting: Quickly generate custom reports for different stakeholders, from your technical teams all the way up to the board.

This kind of dashboard gives you a clear, at-a-glance view of your risk landscape, making it infinitely easier to spot emerging trends and decide where to focus your efforts.

Leveraging Automation for Efficiency

Automation is the engine that really makes your template work for you. Manual processes are not only painfully slow but are also ripe for human error—a mistake that can be incredibly costly in a compliance context. Technology helps automate those repetitive but critical tasks, which frees up your team to focus on more strategic risk management activities. Exploring tools like RPA for compliance and regulatory reporting can be a real game-changer here.

By integrating your template with a GRC tool, you’re not just digitizing a document; you're building an intelligent system that actively helps you manage risk.

For example, you can set up automated workflows that assign and track remediation tasks without anyone having to send a follow-up email. This creates a clear, undeniable audit trail and drives accountability across the organization. We dive deeper into how this works in our guide on https://voicetype.com/blog/document-workflow-automation.

This level of automation ensures that the moment a risk is identified, the path to fixing it is immediate and trackable. It’s what turns your template from a passive document into an active management tool.

Common Mistakes That Undermine Your Efforts

Knowing what not to do is often half the battle. Even the most carefully designed compliance risk assessment template can quickly become useless if you fall into a few common traps. These mistakes don't just weaken your compliance program; they create a false sense of security, which can be even more dangerous than having no process at all.

One of the most frequent errors I see is building the assessment in a vacuum. The compliance or legal team drafts a beautiful template, fills it out based on their own assumptions, and then sends it out to the rest of the company. This "ivory tower" approach is almost always doomed from the start because it completely misses the crucial context from people on the ground.

Without input from business unit leaders—the ones who live and breathe these operations every day—you're just guessing at the real-world likelihood and impact of potential risks. It's a classic case of a process that looks great on paper but falls apart in practice.

Forgetting the Follow-Through

Here's another big one: failing to assign clear ownership and deadlines for fixing the problems you find. Identifying a risk is only step one. If your template doesn't explicitly state who is responsible for mitigating it and by when, that risk is probably going to sit there forever.

Think about it. Your assessment flags a major security vulnerability with a key supplier. Considering that 61% of U.S. companies have experienced a data breach caused by a third party, that's a serious finding. But without a clear owner assigned to vendor management follow-up, it’s just another unread line item on a spreadsheet.

An assessment without an action plan is just an audit of your problems. A great template doesn't just find issues—it forces a resolution by creating clear accountability.

This simple shift turns your template from a static report into a dynamic project management tool, making sure that what you discover actually gets fixed.

Overcomplicating the Process

Finally, remember that complexity is the enemy of adoption. It’s so tempting to build a "perfect" template with dozens of columns, intricate scoring matrices, and complicated formulas. While it might feel thorough, an overly complex template is just intimidating and often gets ignored by the very people you need to use it.

Your goal should be clarity and usability, not academic perfection. A simpler template that actually gets used consistently is far more valuable than a perfect one that collects digital dust.

Here are a few ways to keep your template simple and actionable:

Use plain language: Ditch the jargon. Describe risks in terms that anyone from sales to engineering can understand.

Focus on what matters: Stick to the essential data points: risk description, impact, likelihood, owner, and due date.

Don't just send it, teach it: Never just email the template out. Walk teams through it and explain the "why" behind each field.

By sidestepping these common mistakes, you can ensure your compliance risk assessment template becomes a powerful strategic asset instead of just another box-checking exercise.

Got Questions? We've Got Answers

Stepping into the world of compliance risk assessments can feel a bit like navigating a maze. It’s natural to have questions pop up along the way. Getting straight answers is the best way to keep moving forward, so let's tackle some of the most common ones I hear from folks building out their compliance programs.

How Often Should We Update Our Compliance Risk Assessment?

Think of your risk assessment as a living, breathing document, not a "set it and forget it" report that collects dust on a shelf.

While a full, deep-dive review should happen at least once a year, that’s just the baseline. The real key is to be agile. You absolutely need to revisit your assessment whenever something significant changes. This could be a new law dropping (think GDPR or CCPA), a major business move like opening an office overseas, or, unfortunately, right after a compliance incident occurs. Staying on top of these event-driven updates is what separates a truly effective program from one that's just checking a box.

What’s the Difference Between Inherent and Residual Risk?

This is a big one, and getting it right is fundamental to a solid assessment.

Inherent risk is the raw, unfiltered risk you face before you do anything to stop it. Imagine you’re an e-commerce company; the inherent risk of a data breach is just naturally high because you handle customer data. It's the starting point.

Residual risk is what's left over after you’ve put your defenses in place—things like firewalls, encryption, two-factor authentication, and employee security training. It’s the risk that remains despite your best efforts.

Your template has to track both. There's no way around it. Showing the journey from high inherent risk to low residual risk is how you prove to auditors, regulators, and your own leadership that your compliance controls are actually working and your investments are paying off.

Who Should Be Involved in the Risk Assessment Process?

Whatever you do, don't let this become a solo project for the compliance department. I've seen it happen, and it never ends well. When you work in a silo, you miss the crucial context from the people who are actually on the front lines.

For an assessment to be worth the paper it’s written on, you need to bring people together from across the business. Your team should include folks from:

Legal & Compliance: They’re your experts on interpreting the complex web of regulations.

IT & Security: These are the people who know your technical vulnerabilities and the controls in place to manage them.

Finance & HR: They cover critical areas like financial reporting integrity and employee-related compliance risks.

Operations & Business Units: You need their input to understand the day-to-day operational risks that no one else would even think of.

Getting all these different perspectives is what makes your assessment a true reflection of the business, not just a theoretical exercise.

Can a Small Business Use a Simplified Template?

Of course. The principles of identifying and managing risk apply to everyone, whether you’re a 10-person startup or a multinational corporation.

A small business obviously won't need the same beast of a template that a Fortune 500 company does. You can create a much more focused version that hones in on your most relevant risks—maybe that’s data privacy for customer information, workplace safety, and basic financial rules. The goal isn’t to drown in complexity; it's to build something that’s right-sized and genuinely useful for your business.

Ready to stop typing and start talking? VoiceType helps you draft documents, emails, and reports up to 9x faster with 99.7% accuracy. Join over 65,000 professionals who are saving hours each week. Start your free trial today and transform your workflow.

Think of a compliance risk assessment template as your game plan. It’s a structured document you use to methodically find, analyze, and handle the risks tied to all those legal and regulatory rules your business has to follow. It’s really the bedrock of any solid compliance program.

Why You Need More Than Just a Generic Checklist

Let's be real—compliance can feel like a mountain of paperwork and red tape. But trying to wing it is a recipe for disaster. We're talking about everything from eye-watering GDPR fines to the kind of reputational damage that takes years to repair. A well-built compliance risk assessment template isn't just about checking off boxes; it's a strategic shield that helps you get ahead of threats, use your resources smartly, and protect your company's bottom line.

Forget the one-size-fits-all templates you find online. What truly makes a template work in the real world is its clarity and a direct line from risk to action. It takes dense, abstract legal jargon and turns it into a framework your team can actually use.

Taming the Regulatory Beast

The web of regulations just keeps getting stickier and more complex every year. That's not just a hunch; the numbers back it up. A recent report from Spacelift found that 85% of compliance pros feel regulations are getting harder to navigate, and a staggering 90% say their job responsibilities have expanded as a result. This isn't just an internal headache, either—82% of businesses report that this growing complexity is putting the brakes on their growth and transformation projects.

A solid template is your best tool for cutting through this noise. It gives you a repeatable process to:

Pinpoint every rule that applies to you, from niche industry standards to major data privacy laws like the CCPA.

Rank your risks by how likely they are to happen and how much damage they could cause. This lets you focus your energy where it counts.

Create a consistent standard so that every team, from marketing to product, is evaluating risk the same way.

Shifting from Firefighting to Fire Prevention

Without a template, compliance often turns into a reactive scramble. A problem pops up, and everyone drops what they're doing to put out the fire. Using a template flips that script entirely, letting you get out in front of issues before they blow up. For a fantastic deep-dive on creating this kind of framework, especially in a heavily regulated space, check out this proven bank risk assessment template.

A good template does more than just list what could go wrong. It weaves a culture of risk awareness into the fabric of your company. It becomes the single source of truth that gets legal, IT, and operations on the same page, making sure everyone knows their part in keeping the organization safe.

This proactive mindset is crucial. When you document potential threats and map out your response ahead of time, you're building a defensible position. You can walk into any audit and show regulators you have a thoughtful, organized process for managing compliance. That's how you turn a potential weakness into a real business advantage.

What Goes Into a Truly Effective Template?

What’s the real difference between a compliance risk assessment template that actually works and a glorified spreadsheet that just collects digital dust? It all comes down to the structure. A powerful template isn't just a list of things that could go wrong; it's a living tool that connects abstract regulations to your day-to-day business operations, giving you a clear roadmap from identifying a risk to getting it resolved.

Think of it as the architectural plan for your entire compliance program. If the foundation is weak, the whole structure is unstable. A well-designed template moves beyond vague categories and gives everyone in the organization a specific, standardized framework to follow.

Nail Down Your Regulatory Obligations

The bedrock of any solid risk assessment is knowing exactly which rules you have to play by. This is where your template needs a section to list every single legal, statutory, and contractual obligation your company is bound to. I’m not talking about a high-level summary here—you need to get granular.

For example, instead of a generic entry like "Data Privacy," you should break it down into specifics:

GDPR Article 30: The requirement to maintain detailed records of all data processing activities.

CCPA Section 1798.100: The consumer's right to know what specific pieces of their personal information are being collected.

SOX Section 302: The mandate for principal officers to personally certify the accuracy of financial reports.

Getting this specific is non-negotiable. It makes your entire risk assessment defensible in an audit because you can draw a straight line from a risk back to a concrete legal requirement. This level of detail is a cornerstone of good governance, and you can learn more by exploring some proven documentation best practices.

Define Your Risk Categories and Descriptions

Once you have your obligations listed, the next step is to translate them into specific business risks. "Risk categories" are your friend here—they let you group similar threats, like "Data Security," "Financial Reporting," or "Third-Party Vendor Management." But the real work is in the risk description that follows.

A lazy description like "Vendor issues" is useless. A strong, actionable description is "Failure to conduct adequate security due diligence on a new software vendor, potentially exposing sensitive customer data." See the difference? That level of clarity makes the risk tangible and far easier for everyone to understand and assess.

A great template forces clarity. It makes you move from abstract worries like "cybersecurity" to concrete, assessable scenarios like "unauthorized access to the customer database due to weak password policies."

Build Out Your Impact and Likelihood Scales

This is the part that turns your assessment from a qualitative exercise into a quantitative one. To do this right, you have to define clear, consistent scales for scoring each risk you've identified. Vague terms like "high" or "low" just won't cut it and lead to endless debate.

A simple but highly effective approach is to use a 1-5 scale for both impact and likelihood.

To bring this to life, here's a breakdown of the key columns your template should absolutely include. These elements work together to transform a simple list into a powerful analytical tool.

Essential Elements of a Compliance Risk Assessment Template

Component | Purpose | Example Data Point |

|---|---|---|

Risk ID | Provides a unique identifier for tracking and reference. | FIN-001 |

Risk Category | Groups similar risks for high-level analysis and reporting. | Financial Reporting Integrity |

Regulatory Obligation | Links the risk directly to a specific law, rule, or contract. | SOX Section 302 |

Risk Description | Clearly and concisely explains the specific risk scenario. | Inaccurate financial data reported due to manual spreadsheet errors. |

Existing Controls | Documents the current measures in place to mitigate the risk. | Quarterly internal audits; dual-approval for journal entries. |

Likelihood Score (1-5) | Quantifies the probability of the risk occurring. | 3 (Possible) |

Impact Score (1-5) | Quantifies the severity of the consequences if the risk occurs. | 5 (Critical) |

Inherent Risk Score | Calculates the risk level before controls (Likelihood x Impact). | 15 |

Residual Risk Score | Calculates the risk level after controls are considered. | 8 |

Action Plan | Outlines the specific steps needed to further mitigate the risk. | Implement automated reporting software by Q3. |

Owner | Assigns a specific person responsible for the action plan. | Jane Doe, Controller |

Due Date | Sets a clear deadline for the action plan's completion. | September 30, 2024 |

Having these components in place ensures you're not just identifying problems but also assigning ownership and creating a clear path to resolution.

By multiplying the likelihood and impact scores, you get a risk rating (e.g., a Likelihood of 5 x an Impact of 5 = a Risk Score of 25). This simple calculation is the engine of your template, allowing you to instantly sort and prioritize which issues need your attention right now. It turns a long list of worries into an objective, data-driven action plan.

How to Build Your Template from the Ground Up

Okay, let's move from the abstract idea of a template to actually building one. This is where the rubber meets the road, and a well-designed compliance risk assessment template shows its true value. Building one from scratch might sound like a huge undertaking, but it’s really about structured thinking and clear communication, not complicated formulas.

Think about a typical mid-sized tech company that handles sensitive customer data. Their first move isn't to jump into a spreadsheet. It's to get the right people in a room. This can't be a siloed task for the legal team; you need a mix of experts from IT, operations, legal, and even product development to see the full picture.

This workflow visualization breaks down how you can bring your own template to life, from the initial discovery phase all the way to resolving the issues you find.

This simple flow—Identify, Analyze, Remediate—is the foundation of any solid compliance program. It turns what could be a chaotic process into something you can repeat, scale, and rely on.

Identifying Your Specific Risks

Once you have your team assembled, the first order of business is a good old-fashioned brainstorm. The goal is to get every potential compliance risk out on the table. A great way to start is by looking at the big-picture regulations that apply to you, like GDPR or CCPA, and then digging into the specific ways they impact your daily operations.

For our imaginary tech company, a workshop might surface risks like these:

Data Breach Risk: Someone gains unauthorized access to the cloud databases where we store customer Personally Identifiable Information (PII).

Vendor Management Risk: A third-party marketing tool we use doesn't meet the data security standards laid out in our contract.

Access Control Risk: We discover that former employees still have active credentials for sensitive internal systems after they've left the company.

Notice how specific these are? They’re tied to actual business processes. Vague entries like "cybersecurity risk" are useless because you can't score them or figure out how to fix them.

Scoring Risks and Documenting Controls

After you've got a solid list of potential risks, it's time to analyze them. This is where you assign scores for likelihood (what are the odds of this happening?) and impact (how bad would it be if it did?). A simple 1-to-5 scale for both works wonders.

Let’s use the "Unauthorized access to customer PII" risk as an example. The team might decide its likelihood is a 4 (Likely) and its impact is a 5 (Critical). Multiply those, and you get an inherent risk score of 20, immediately flagging it as a top priority.

Next, you need to document the controls you already have in place to manage this risk. This could be anything from multi-factor authentication (MFA) and data encryption to your quarterly access reviews. Documenting these is vital because they help you figure out the residual risk—the risk that's left over after your safeguards are doing their job.

The point of a risk assessment isn't to get to zero risk—that’s a fantasy. It's about understanding your risks so deeply that you can manage them down to an acceptable level and show regulators you have a thoughtful, defensible process.

Creating Actionable Remediation Plans

This last part is arguably the most important: turning your findings into action. For every high-priority risk, your template needs a section for a clear remediation plan. I'm not talking about a vague suggestion; I mean a concrete to-do list with names and dates attached.

This isn't just best practice; it's what leading organizations do. In fact, 61% of professionals use their risk assessment results as the primary driver for improving their compliance programs, according to Navex Global's 2025 report. For more on how companies are tackling these issues, you can explore detailed compliance statistics.

A powerful remediation plan always includes:

A Specific Action: "Implement role-based access control (RBAC) for the production database."

An Assigned Owner: "John Smith, Head of Engineering."

A Firm Deadline: "End of Q3."

This simple addition transforms your template from a static document into a living, breathing project management tool. It ensures the problems you find don't just get filed away in a report—they actually get fixed. For more help formalizing processes like these, take a look at our guide on how to create standard operating procedures. By assigning ownership and timelines, you build a culture where everyone is accountable for continuous improvement.

Using Technology to Supercharge Your Template

Let's be honest: a static spreadsheet can only take you so far. To really stay on top of today's tangled regulatory web, you need to transform your compliance risk assessment template from a simple document into a living, breathing system. This is where technology—specifically Governance, Risk, and Compliance (GRC) software—comes in, turning a periodic chore into a continuous, value-adding process.

Instead of a template that gets a dusty, once-a-quarter update, picture a system that gives you real-time visibility. The right tools can automate control testing, pull all your compliance documentation into one place, and spit out executive-ready dashboards with a single click.

Moving from Static to Dynamic

The most significant upgrade you can make is shifting from a point-in-time snapshot to a continuous monitoring model. A spreadsheet is already outdated the moment you hit "save," but a tech-driven system offers a live look at your compliance posture.

This isn't just a nice-to-have; it's becoming essential. Regulations are only getting more complicated. According to PwC's Global Compliance Survey 2025, a staggering 77% of executives said compliance complexity had negatively impacted them, and 51% put technology risks at the top of their priority list. It's no wonder that organizations are turning to digital tools for dynamic risk scoring and real-time monitoring. You can check out some of the top compliance risk assessment tools on centraleyes.com to see what’s out there.

A good GRC platform will typically offer:

Automated Alerts: Get pinged the moment a control fails or a risk score crosses a critical threshold.

Centralized Evidence: No more hunting through shared drives. All audit evidence, policies, and procedures live in one accessible spot.

Streamlined Reporting: Quickly generate custom reports for different stakeholders, from your technical teams all the way up to the board.

This kind of dashboard gives you a clear, at-a-glance view of your risk landscape, making it infinitely easier to spot emerging trends and decide where to focus your efforts.

Leveraging Automation for Efficiency

Automation is the engine that really makes your template work for you. Manual processes are not only painfully slow but are also ripe for human error—a mistake that can be incredibly costly in a compliance context. Technology helps automate those repetitive but critical tasks, which frees up your team to focus on more strategic risk management activities. Exploring tools like RPA for compliance and regulatory reporting can be a real game-changer here.

By integrating your template with a GRC tool, you’re not just digitizing a document; you're building an intelligent system that actively helps you manage risk.

For example, you can set up automated workflows that assign and track remediation tasks without anyone having to send a follow-up email. This creates a clear, undeniable audit trail and drives accountability across the organization. We dive deeper into how this works in our guide on https://voicetype.com/blog/document-workflow-automation.

This level of automation ensures that the moment a risk is identified, the path to fixing it is immediate and trackable. It’s what turns your template from a passive document into an active management tool.

Common Mistakes That Undermine Your Efforts

Knowing what not to do is often half the battle. Even the most carefully designed compliance risk assessment template can quickly become useless if you fall into a few common traps. These mistakes don't just weaken your compliance program; they create a false sense of security, which can be even more dangerous than having no process at all.

One of the most frequent errors I see is building the assessment in a vacuum. The compliance or legal team drafts a beautiful template, fills it out based on their own assumptions, and then sends it out to the rest of the company. This "ivory tower" approach is almost always doomed from the start because it completely misses the crucial context from people on the ground.

Without input from business unit leaders—the ones who live and breathe these operations every day—you're just guessing at the real-world likelihood and impact of potential risks. It's a classic case of a process that looks great on paper but falls apart in practice.

Forgetting the Follow-Through

Here's another big one: failing to assign clear ownership and deadlines for fixing the problems you find. Identifying a risk is only step one. If your template doesn't explicitly state who is responsible for mitigating it and by when, that risk is probably going to sit there forever.

Think about it. Your assessment flags a major security vulnerability with a key supplier. Considering that 61% of U.S. companies have experienced a data breach caused by a third party, that's a serious finding. But without a clear owner assigned to vendor management follow-up, it’s just another unread line item on a spreadsheet.

An assessment without an action plan is just an audit of your problems. A great template doesn't just find issues—it forces a resolution by creating clear accountability.

This simple shift turns your template from a static report into a dynamic project management tool, making sure that what you discover actually gets fixed.

Overcomplicating the Process

Finally, remember that complexity is the enemy of adoption. It’s so tempting to build a "perfect" template with dozens of columns, intricate scoring matrices, and complicated formulas. While it might feel thorough, an overly complex template is just intimidating and often gets ignored by the very people you need to use it.

Your goal should be clarity and usability, not academic perfection. A simpler template that actually gets used consistently is far more valuable than a perfect one that collects digital dust.

Here are a few ways to keep your template simple and actionable:

Use plain language: Ditch the jargon. Describe risks in terms that anyone from sales to engineering can understand.

Focus on what matters: Stick to the essential data points: risk description, impact, likelihood, owner, and due date.

Don't just send it, teach it: Never just email the template out. Walk teams through it and explain the "why" behind each field.

By sidestepping these common mistakes, you can ensure your compliance risk assessment template becomes a powerful strategic asset instead of just another box-checking exercise.

Got Questions? We've Got Answers

Stepping into the world of compliance risk assessments can feel a bit like navigating a maze. It’s natural to have questions pop up along the way. Getting straight answers is the best way to keep moving forward, so let's tackle some of the most common ones I hear from folks building out their compliance programs.

How Often Should We Update Our Compliance Risk Assessment?

Think of your risk assessment as a living, breathing document, not a "set it and forget it" report that collects dust on a shelf.

While a full, deep-dive review should happen at least once a year, that’s just the baseline. The real key is to be agile. You absolutely need to revisit your assessment whenever something significant changes. This could be a new law dropping (think GDPR or CCPA), a major business move like opening an office overseas, or, unfortunately, right after a compliance incident occurs. Staying on top of these event-driven updates is what separates a truly effective program from one that's just checking a box.

What’s the Difference Between Inherent and Residual Risk?

This is a big one, and getting it right is fundamental to a solid assessment.

Inherent risk is the raw, unfiltered risk you face before you do anything to stop it. Imagine you’re an e-commerce company; the inherent risk of a data breach is just naturally high because you handle customer data. It's the starting point.

Residual risk is what's left over after you’ve put your defenses in place—things like firewalls, encryption, two-factor authentication, and employee security training. It’s the risk that remains despite your best efforts.

Your template has to track both. There's no way around it. Showing the journey from high inherent risk to low residual risk is how you prove to auditors, regulators, and your own leadership that your compliance controls are actually working and your investments are paying off.

Who Should Be Involved in the Risk Assessment Process?

Whatever you do, don't let this become a solo project for the compliance department. I've seen it happen, and it never ends well. When you work in a silo, you miss the crucial context from the people who are actually on the front lines.

For an assessment to be worth the paper it’s written on, you need to bring people together from across the business. Your team should include folks from:

Legal & Compliance: They’re your experts on interpreting the complex web of regulations.

IT & Security: These are the people who know your technical vulnerabilities and the controls in place to manage them.

Finance & HR: They cover critical areas like financial reporting integrity and employee-related compliance risks.

Operations & Business Units: You need their input to understand the day-to-day operational risks that no one else would even think of.

Getting all these different perspectives is what makes your assessment a true reflection of the business, not just a theoretical exercise.

Can a Small Business Use a Simplified Template?

Of course. The principles of identifying and managing risk apply to everyone, whether you’re a 10-person startup or a multinational corporation.

A small business obviously won't need the same beast of a template that a Fortune 500 company does. You can create a much more focused version that hones in on your most relevant risks—maybe that’s data privacy for customer information, workplace safety, and basic financial rules. The goal isn’t to drown in complexity; it's to build something that’s right-sized and genuinely useful for your business.

Ready to stop typing and start talking? VoiceType helps you draft documents, emails, and reports up to 9x faster with 99.7% accuracy. Join over 65,000 professionals who are saving hours each week. Start your free trial today and transform your workflow.

Think of a compliance risk assessment template as your game plan. It’s a structured document you use to methodically find, analyze, and handle the risks tied to all those legal and regulatory rules your business has to follow. It’s really the bedrock of any solid compliance program.

Why You Need More Than Just a Generic Checklist

Let's be real—compliance can feel like a mountain of paperwork and red tape. But trying to wing it is a recipe for disaster. We're talking about everything from eye-watering GDPR fines to the kind of reputational damage that takes years to repair. A well-built compliance risk assessment template isn't just about checking off boxes; it's a strategic shield that helps you get ahead of threats, use your resources smartly, and protect your company's bottom line.

Forget the one-size-fits-all templates you find online. What truly makes a template work in the real world is its clarity and a direct line from risk to action. It takes dense, abstract legal jargon and turns it into a framework your team can actually use.

Taming the Regulatory Beast

The web of regulations just keeps getting stickier and more complex every year. That's not just a hunch; the numbers back it up. A recent report from Spacelift found that 85% of compliance pros feel regulations are getting harder to navigate, and a staggering 90% say their job responsibilities have expanded as a result. This isn't just an internal headache, either—82% of businesses report that this growing complexity is putting the brakes on their growth and transformation projects.

A solid template is your best tool for cutting through this noise. It gives you a repeatable process to:

Pinpoint every rule that applies to you, from niche industry standards to major data privacy laws like the CCPA.

Rank your risks by how likely they are to happen and how much damage they could cause. This lets you focus your energy where it counts.

Create a consistent standard so that every team, from marketing to product, is evaluating risk the same way.

Shifting from Firefighting to Fire Prevention

Without a template, compliance often turns into a reactive scramble. A problem pops up, and everyone drops what they're doing to put out the fire. Using a template flips that script entirely, letting you get out in front of issues before they blow up. For a fantastic deep-dive on creating this kind of framework, especially in a heavily regulated space, check out this proven bank risk assessment template.

A good template does more than just list what could go wrong. It weaves a culture of risk awareness into the fabric of your company. It becomes the single source of truth that gets legal, IT, and operations on the same page, making sure everyone knows their part in keeping the organization safe.

This proactive mindset is crucial. When you document potential threats and map out your response ahead of time, you're building a defensible position. You can walk into any audit and show regulators you have a thoughtful, organized process for managing compliance. That's how you turn a potential weakness into a real business advantage.

What Goes Into a Truly Effective Template?

What’s the real difference between a compliance risk assessment template that actually works and a glorified spreadsheet that just collects digital dust? It all comes down to the structure. A powerful template isn't just a list of things that could go wrong; it's a living tool that connects abstract regulations to your day-to-day business operations, giving you a clear roadmap from identifying a risk to getting it resolved.

Think of it as the architectural plan for your entire compliance program. If the foundation is weak, the whole structure is unstable. A well-designed template moves beyond vague categories and gives everyone in the organization a specific, standardized framework to follow.

Nail Down Your Regulatory Obligations

The bedrock of any solid risk assessment is knowing exactly which rules you have to play by. This is where your template needs a section to list every single legal, statutory, and contractual obligation your company is bound to. I’m not talking about a high-level summary here—you need to get granular.

For example, instead of a generic entry like "Data Privacy," you should break it down into specifics:

GDPR Article 30: The requirement to maintain detailed records of all data processing activities.

CCPA Section 1798.100: The consumer's right to know what specific pieces of their personal information are being collected.

SOX Section 302: The mandate for principal officers to personally certify the accuracy of financial reports.

Getting this specific is non-negotiable. It makes your entire risk assessment defensible in an audit because you can draw a straight line from a risk back to a concrete legal requirement. This level of detail is a cornerstone of good governance, and you can learn more by exploring some proven documentation best practices.

Define Your Risk Categories and Descriptions

Once you have your obligations listed, the next step is to translate them into specific business risks. "Risk categories" are your friend here—they let you group similar threats, like "Data Security," "Financial Reporting," or "Third-Party Vendor Management." But the real work is in the risk description that follows.

A lazy description like "Vendor issues" is useless. A strong, actionable description is "Failure to conduct adequate security due diligence on a new software vendor, potentially exposing sensitive customer data." See the difference? That level of clarity makes the risk tangible and far easier for everyone to understand and assess.

A great template forces clarity. It makes you move from abstract worries like "cybersecurity" to concrete, assessable scenarios like "unauthorized access to the customer database due to weak password policies."

Build Out Your Impact and Likelihood Scales

This is the part that turns your assessment from a qualitative exercise into a quantitative one. To do this right, you have to define clear, consistent scales for scoring each risk you've identified. Vague terms like "high" or "low" just won't cut it and lead to endless debate.

A simple but highly effective approach is to use a 1-5 scale for both impact and likelihood.

To bring this to life, here's a breakdown of the key columns your template should absolutely include. These elements work together to transform a simple list into a powerful analytical tool.

Essential Elements of a Compliance Risk Assessment Template

Component | Purpose | Example Data Point |

|---|---|---|

Risk ID | Provides a unique identifier for tracking and reference. | FIN-001 |

Risk Category | Groups similar risks for high-level analysis and reporting. | Financial Reporting Integrity |

Regulatory Obligation | Links the risk directly to a specific law, rule, or contract. | SOX Section 302 |

Risk Description | Clearly and concisely explains the specific risk scenario. | Inaccurate financial data reported due to manual spreadsheet errors. |

Existing Controls | Documents the current measures in place to mitigate the risk. | Quarterly internal audits; dual-approval for journal entries. |

Likelihood Score (1-5) | Quantifies the probability of the risk occurring. | 3 (Possible) |

Impact Score (1-5) | Quantifies the severity of the consequences if the risk occurs. | 5 (Critical) |

Inherent Risk Score | Calculates the risk level before controls (Likelihood x Impact). | 15 |

Residual Risk Score | Calculates the risk level after controls are considered. | 8 |

Action Plan | Outlines the specific steps needed to further mitigate the risk. | Implement automated reporting software by Q3. |

Owner | Assigns a specific person responsible for the action plan. | Jane Doe, Controller |

Due Date | Sets a clear deadline for the action plan's completion. | September 30, 2024 |

Having these components in place ensures you're not just identifying problems but also assigning ownership and creating a clear path to resolution.

By multiplying the likelihood and impact scores, you get a risk rating (e.g., a Likelihood of 5 x an Impact of 5 = a Risk Score of 25). This simple calculation is the engine of your template, allowing you to instantly sort and prioritize which issues need your attention right now. It turns a long list of worries into an objective, data-driven action plan.

How to Build Your Template from the Ground Up

Okay, let's move from the abstract idea of a template to actually building one. This is where the rubber meets the road, and a well-designed compliance risk assessment template shows its true value. Building one from scratch might sound like a huge undertaking, but it’s really about structured thinking and clear communication, not complicated formulas.

Think about a typical mid-sized tech company that handles sensitive customer data. Their first move isn't to jump into a spreadsheet. It's to get the right people in a room. This can't be a siloed task for the legal team; you need a mix of experts from IT, operations, legal, and even product development to see the full picture.

This workflow visualization breaks down how you can bring your own template to life, from the initial discovery phase all the way to resolving the issues you find.

This simple flow—Identify, Analyze, Remediate—is the foundation of any solid compliance program. It turns what could be a chaotic process into something you can repeat, scale, and rely on.

Identifying Your Specific Risks

Once you have your team assembled, the first order of business is a good old-fashioned brainstorm. The goal is to get every potential compliance risk out on the table. A great way to start is by looking at the big-picture regulations that apply to you, like GDPR or CCPA, and then digging into the specific ways they impact your daily operations.

For our imaginary tech company, a workshop might surface risks like these:

Data Breach Risk: Someone gains unauthorized access to the cloud databases where we store customer Personally Identifiable Information (PII).

Vendor Management Risk: A third-party marketing tool we use doesn't meet the data security standards laid out in our contract.

Access Control Risk: We discover that former employees still have active credentials for sensitive internal systems after they've left the company.

Notice how specific these are? They’re tied to actual business processes. Vague entries like "cybersecurity risk" are useless because you can't score them or figure out how to fix them.

Scoring Risks and Documenting Controls

After you've got a solid list of potential risks, it's time to analyze them. This is where you assign scores for likelihood (what are the odds of this happening?) and impact (how bad would it be if it did?). A simple 1-to-5 scale for both works wonders.

Let’s use the "Unauthorized access to customer PII" risk as an example. The team might decide its likelihood is a 4 (Likely) and its impact is a 5 (Critical). Multiply those, and you get an inherent risk score of 20, immediately flagging it as a top priority.

Next, you need to document the controls you already have in place to manage this risk. This could be anything from multi-factor authentication (MFA) and data encryption to your quarterly access reviews. Documenting these is vital because they help you figure out the residual risk—the risk that's left over after your safeguards are doing their job.

The point of a risk assessment isn't to get to zero risk—that’s a fantasy. It's about understanding your risks so deeply that you can manage them down to an acceptable level and show regulators you have a thoughtful, defensible process.

Creating Actionable Remediation Plans

This last part is arguably the most important: turning your findings into action. For every high-priority risk, your template needs a section for a clear remediation plan. I'm not talking about a vague suggestion; I mean a concrete to-do list with names and dates attached.

This isn't just best practice; it's what leading organizations do. In fact, 61% of professionals use their risk assessment results as the primary driver for improving their compliance programs, according to Navex Global's 2025 report. For more on how companies are tackling these issues, you can explore detailed compliance statistics.

A powerful remediation plan always includes:

A Specific Action: "Implement role-based access control (RBAC) for the production database."

An Assigned Owner: "John Smith, Head of Engineering."

A Firm Deadline: "End of Q3."

This simple addition transforms your template from a static document into a living, breathing project management tool. It ensures the problems you find don't just get filed away in a report—they actually get fixed. For more help formalizing processes like these, take a look at our guide on how to create standard operating procedures. By assigning ownership and timelines, you build a culture where everyone is accountable for continuous improvement.

Using Technology to Supercharge Your Template

Let's be honest: a static spreadsheet can only take you so far. To really stay on top of today's tangled regulatory web, you need to transform your compliance risk assessment template from a simple document into a living, breathing system. This is where technology—specifically Governance, Risk, and Compliance (GRC) software—comes in, turning a periodic chore into a continuous, value-adding process.

Instead of a template that gets a dusty, once-a-quarter update, picture a system that gives you real-time visibility. The right tools can automate control testing, pull all your compliance documentation into one place, and spit out executive-ready dashboards with a single click.

Moving from Static to Dynamic

The most significant upgrade you can make is shifting from a point-in-time snapshot to a continuous monitoring model. A spreadsheet is already outdated the moment you hit "save," but a tech-driven system offers a live look at your compliance posture.

This isn't just a nice-to-have; it's becoming essential. Regulations are only getting more complicated. According to PwC's Global Compliance Survey 2025, a staggering 77% of executives said compliance complexity had negatively impacted them, and 51% put technology risks at the top of their priority list. It's no wonder that organizations are turning to digital tools for dynamic risk scoring and real-time monitoring. You can check out some of the top compliance risk assessment tools on centraleyes.com to see what’s out there.

A good GRC platform will typically offer:

Automated Alerts: Get pinged the moment a control fails or a risk score crosses a critical threshold.

Centralized Evidence: No more hunting through shared drives. All audit evidence, policies, and procedures live in one accessible spot.

Streamlined Reporting: Quickly generate custom reports for different stakeholders, from your technical teams all the way up to the board.

This kind of dashboard gives you a clear, at-a-glance view of your risk landscape, making it infinitely easier to spot emerging trends and decide where to focus your efforts.

Leveraging Automation for Efficiency

Automation is the engine that really makes your template work for you. Manual processes are not only painfully slow but are also ripe for human error—a mistake that can be incredibly costly in a compliance context. Technology helps automate those repetitive but critical tasks, which frees up your team to focus on more strategic risk management activities. Exploring tools like RPA for compliance and regulatory reporting can be a real game-changer here.

By integrating your template with a GRC tool, you’re not just digitizing a document; you're building an intelligent system that actively helps you manage risk.

For example, you can set up automated workflows that assign and track remediation tasks without anyone having to send a follow-up email. This creates a clear, undeniable audit trail and drives accountability across the organization. We dive deeper into how this works in our guide on https://voicetype.com/blog/document-workflow-automation.

This level of automation ensures that the moment a risk is identified, the path to fixing it is immediate and trackable. It’s what turns your template from a passive document into an active management tool.

Common Mistakes That Undermine Your Efforts

Knowing what not to do is often half the battle. Even the most carefully designed compliance risk assessment template can quickly become useless if you fall into a few common traps. These mistakes don't just weaken your compliance program; they create a false sense of security, which can be even more dangerous than having no process at all.

One of the most frequent errors I see is building the assessment in a vacuum. The compliance or legal team drafts a beautiful template, fills it out based on their own assumptions, and then sends it out to the rest of the company. This "ivory tower" approach is almost always doomed from the start because it completely misses the crucial context from people on the ground.

Without input from business unit leaders—the ones who live and breathe these operations every day—you're just guessing at the real-world likelihood and impact of potential risks. It's a classic case of a process that looks great on paper but falls apart in practice.

Forgetting the Follow-Through

Here's another big one: failing to assign clear ownership and deadlines for fixing the problems you find. Identifying a risk is only step one. If your template doesn't explicitly state who is responsible for mitigating it and by when, that risk is probably going to sit there forever.

Think about it. Your assessment flags a major security vulnerability with a key supplier. Considering that 61% of U.S. companies have experienced a data breach caused by a third party, that's a serious finding. But without a clear owner assigned to vendor management follow-up, it’s just another unread line item on a spreadsheet.

An assessment without an action plan is just an audit of your problems. A great template doesn't just find issues—it forces a resolution by creating clear accountability.

This simple shift turns your template from a static report into a dynamic project management tool, making sure that what you discover actually gets fixed.

Overcomplicating the Process

Finally, remember that complexity is the enemy of adoption. It’s so tempting to build a "perfect" template with dozens of columns, intricate scoring matrices, and complicated formulas. While it might feel thorough, an overly complex template is just intimidating and often gets ignored by the very people you need to use it.

Your goal should be clarity and usability, not academic perfection. A simpler template that actually gets used consistently is far more valuable than a perfect one that collects digital dust.

Here are a few ways to keep your template simple and actionable:

Use plain language: Ditch the jargon. Describe risks in terms that anyone from sales to engineering can understand.

Focus on what matters: Stick to the essential data points: risk description, impact, likelihood, owner, and due date.

Don't just send it, teach it: Never just email the template out. Walk teams through it and explain the "why" behind each field.

By sidestepping these common mistakes, you can ensure your compliance risk assessment template becomes a powerful strategic asset instead of just another box-checking exercise.

Got Questions? We've Got Answers

Stepping into the world of compliance risk assessments can feel a bit like navigating a maze. It’s natural to have questions pop up along the way. Getting straight answers is the best way to keep moving forward, so let's tackle some of the most common ones I hear from folks building out their compliance programs.

How Often Should We Update Our Compliance Risk Assessment?

Think of your risk assessment as a living, breathing document, not a "set it and forget it" report that collects dust on a shelf.

While a full, deep-dive review should happen at least once a year, that’s just the baseline. The real key is to be agile. You absolutely need to revisit your assessment whenever something significant changes. This could be a new law dropping (think GDPR or CCPA), a major business move like opening an office overseas, or, unfortunately, right after a compliance incident occurs. Staying on top of these event-driven updates is what separates a truly effective program from one that's just checking a box.

What’s the Difference Between Inherent and Residual Risk?

This is a big one, and getting it right is fundamental to a solid assessment.

Inherent risk is the raw, unfiltered risk you face before you do anything to stop it. Imagine you’re an e-commerce company; the inherent risk of a data breach is just naturally high because you handle customer data. It's the starting point.

Residual risk is what's left over after you’ve put your defenses in place—things like firewalls, encryption, two-factor authentication, and employee security training. It’s the risk that remains despite your best efforts.

Your template has to track both. There's no way around it. Showing the journey from high inherent risk to low residual risk is how you prove to auditors, regulators, and your own leadership that your compliance controls are actually working and your investments are paying off.

Who Should Be Involved in the Risk Assessment Process?

Whatever you do, don't let this become a solo project for the compliance department. I've seen it happen, and it never ends well. When you work in a silo, you miss the crucial context from the people who are actually on the front lines.

For an assessment to be worth the paper it’s written on, you need to bring people together from across the business. Your team should include folks from:

Legal & Compliance: They’re your experts on interpreting the complex web of regulations.

IT & Security: These are the people who know your technical vulnerabilities and the controls in place to manage them.

Finance & HR: They cover critical areas like financial reporting integrity and employee-related compliance risks.

Operations & Business Units: You need their input to understand the day-to-day operational risks that no one else would even think of.

Getting all these different perspectives is what makes your assessment a true reflection of the business, not just a theoretical exercise.

Can a Small Business Use a Simplified Template?

Of course. The principles of identifying and managing risk apply to everyone, whether you’re a 10-person startup or a multinational corporation.

A small business obviously won't need the same beast of a template that a Fortune 500 company does. You can create a much more focused version that hones in on your most relevant risks—maybe that’s data privacy for customer information, workplace safety, and basic financial rules. The goal isn’t to drown in complexity; it's to build something that’s right-sized and genuinely useful for your business.

Ready to stop typing and start talking? VoiceType helps you draft documents, emails, and reports up to 9x faster with 99.7% accuracy. Join over 65,000 professionals who are saving hours each week. Start your free trial today and transform your workflow.

Think of a compliance risk assessment template as your game plan. It’s a structured document you use to methodically find, analyze, and handle the risks tied to all those legal and regulatory rules your business has to follow. It’s really the bedrock of any solid compliance program.

Why You Need More Than Just a Generic Checklist

Let's be real—compliance can feel like a mountain of paperwork and red tape. But trying to wing it is a recipe for disaster. We're talking about everything from eye-watering GDPR fines to the kind of reputational damage that takes years to repair. A well-built compliance risk assessment template isn't just about checking off boxes; it's a strategic shield that helps you get ahead of threats, use your resources smartly, and protect your company's bottom line.

Forget the one-size-fits-all templates you find online. What truly makes a template work in the real world is its clarity and a direct line from risk to action. It takes dense, abstract legal jargon and turns it into a framework your team can actually use.

Taming the Regulatory Beast

The web of regulations just keeps getting stickier and more complex every year. That's not just a hunch; the numbers back it up. A recent report from Spacelift found that 85% of compliance pros feel regulations are getting harder to navigate, and a staggering 90% say their job responsibilities have expanded as a result. This isn't just an internal headache, either—82% of businesses report that this growing complexity is putting the brakes on their growth and transformation projects.

A solid template is your best tool for cutting through this noise. It gives you a repeatable process to:

Pinpoint every rule that applies to you, from niche industry standards to major data privacy laws like the CCPA.

Rank your risks by how likely they are to happen and how much damage they could cause. This lets you focus your energy where it counts.

Create a consistent standard so that every team, from marketing to product, is evaluating risk the same way.

Shifting from Firefighting to Fire Prevention

Without a template, compliance often turns into a reactive scramble. A problem pops up, and everyone drops what they're doing to put out the fire. Using a template flips that script entirely, letting you get out in front of issues before they blow up. For a fantastic deep-dive on creating this kind of framework, especially in a heavily regulated space, check out this proven bank risk assessment template.

A good template does more than just list what could go wrong. It weaves a culture of risk awareness into the fabric of your company. It becomes the single source of truth that gets legal, IT, and operations on the same page, making sure everyone knows their part in keeping the organization safe.

This proactive mindset is crucial. When you document potential threats and map out your response ahead of time, you're building a defensible position. You can walk into any audit and show regulators you have a thoughtful, organized process for managing compliance. That's how you turn a potential weakness into a real business advantage.

What Goes Into a Truly Effective Template?

What’s the real difference between a compliance risk assessment template that actually works and a glorified spreadsheet that just collects digital dust? It all comes down to the structure. A powerful template isn't just a list of things that could go wrong; it's a living tool that connects abstract regulations to your day-to-day business operations, giving you a clear roadmap from identifying a risk to getting it resolved.

Think of it as the architectural plan for your entire compliance program. If the foundation is weak, the whole structure is unstable. A well-designed template moves beyond vague categories and gives everyone in the organization a specific, standardized framework to follow.

Nail Down Your Regulatory Obligations

The bedrock of any solid risk assessment is knowing exactly which rules you have to play by. This is where your template needs a section to list every single legal, statutory, and contractual obligation your company is bound to. I’m not talking about a high-level summary here—you need to get granular.

For example, instead of a generic entry like "Data Privacy," you should break it down into specifics:

GDPR Article 30: The requirement to maintain detailed records of all data processing activities.

CCPA Section 1798.100: The consumer's right to know what specific pieces of their personal information are being collected.

SOX Section 302: The mandate for principal officers to personally certify the accuracy of financial reports.

Getting this specific is non-negotiable. It makes your entire risk assessment defensible in an audit because you can draw a straight line from a risk back to a concrete legal requirement. This level of detail is a cornerstone of good governance, and you can learn more by exploring some proven documentation best practices.

Define Your Risk Categories and Descriptions

Once you have your obligations listed, the next step is to translate them into specific business risks. "Risk categories" are your friend here—they let you group similar threats, like "Data Security," "Financial Reporting," or "Third-Party Vendor Management." But the real work is in the risk description that follows.

A lazy description like "Vendor issues" is useless. A strong, actionable description is "Failure to conduct adequate security due diligence on a new software vendor, potentially exposing sensitive customer data." See the difference? That level of clarity makes the risk tangible and far easier for everyone to understand and assess.

A great template forces clarity. It makes you move from abstract worries like "cybersecurity" to concrete, assessable scenarios like "unauthorized access to the customer database due to weak password policies."

Build Out Your Impact and Likelihood Scales

This is the part that turns your assessment from a qualitative exercise into a quantitative one. To do this right, you have to define clear, consistent scales for scoring each risk you've identified. Vague terms like "high" or "low" just won't cut it and lead to endless debate.

A simple but highly effective approach is to use a 1-5 scale for both impact and likelihood.

To bring this to life, here's a breakdown of the key columns your template should absolutely include. These elements work together to transform a simple list into a powerful analytical tool.

Essential Elements of a Compliance Risk Assessment Template

Component | Purpose | Example Data Point |

|---|---|---|

Risk ID | Provides a unique identifier for tracking and reference. | FIN-001 |

Risk Category | Groups similar risks for high-level analysis and reporting. | Financial Reporting Integrity |

Regulatory Obligation | Links the risk directly to a specific law, rule, or contract. | SOX Section 302 |

Risk Description | Clearly and concisely explains the specific risk scenario. | Inaccurate financial data reported due to manual spreadsheet errors. |

Existing Controls | Documents the current measures in place to mitigate the risk. | Quarterly internal audits; dual-approval for journal entries. |

Likelihood Score (1-5) | Quantifies the probability of the risk occurring. | 3 (Possible) |

Impact Score (1-5) | Quantifies the severity of the consequences if the risk occurs. | 5 (Critical) |

Inherent Risk Score | Calculates the risk level before controls (Likelihood x Impact). | 15 |